From Complexity to Simplicity

Hashnote • 2023 - 2024 • Product Designer

Crypto

DeFi

Fintech

Project Type: Institutional Crypto Investor Portal

Role & Scope: Product Designer. Research, UX, UI, Design Systems

Team: Stakeholder, Customer Success, Engineering, Legal, Product Design

Outcome: Supported platform scaling to $1.5B AUM

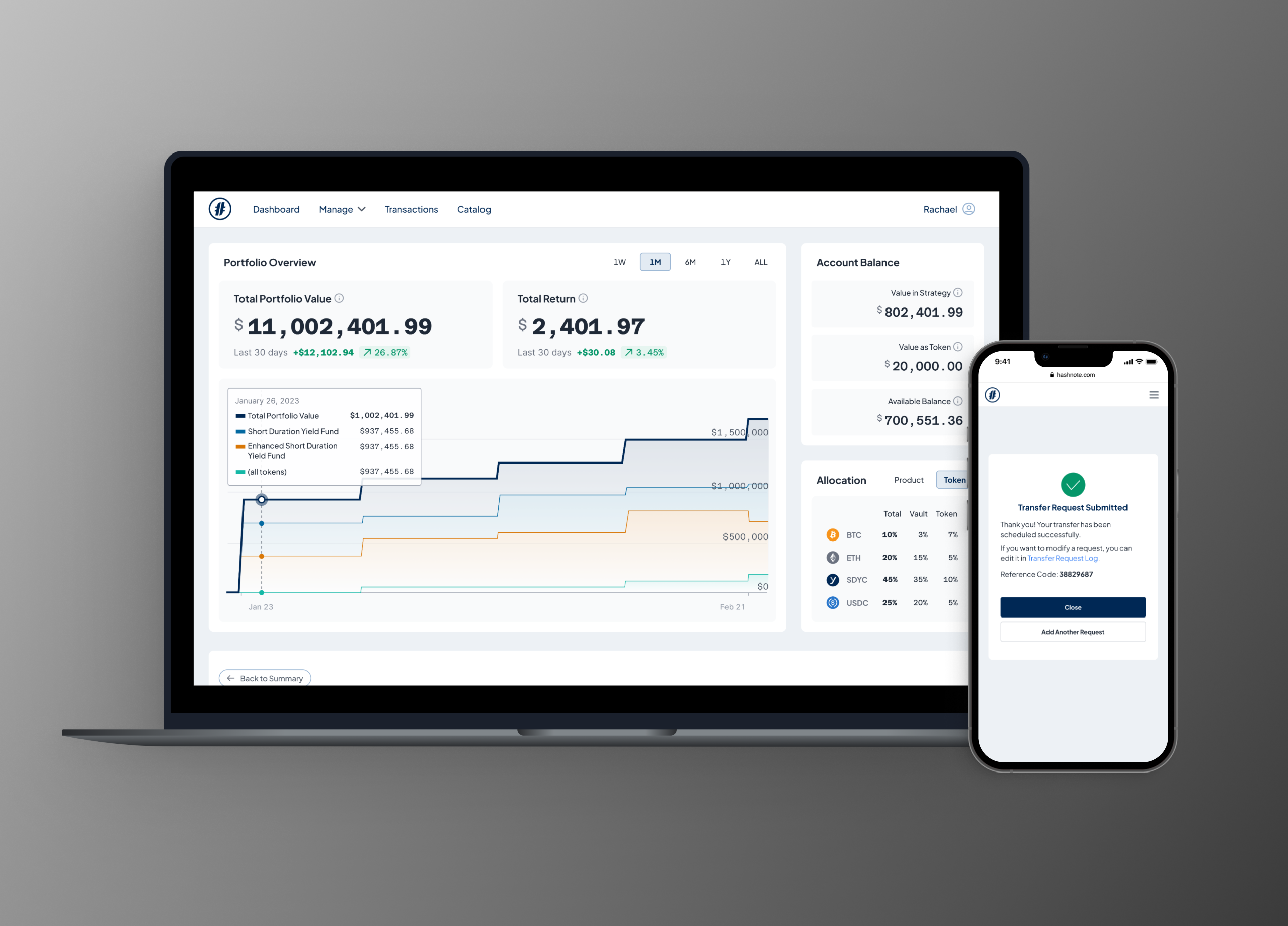

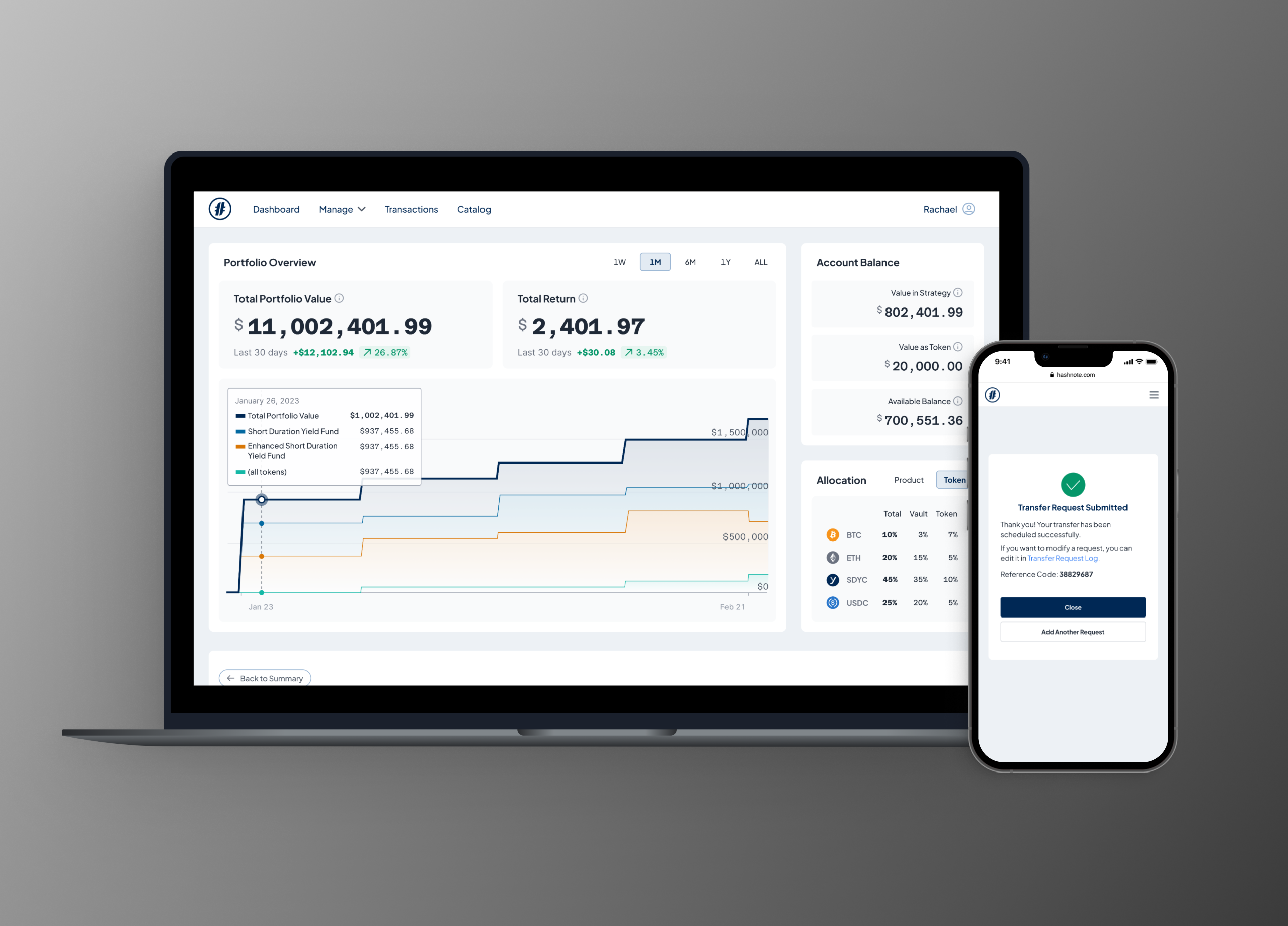

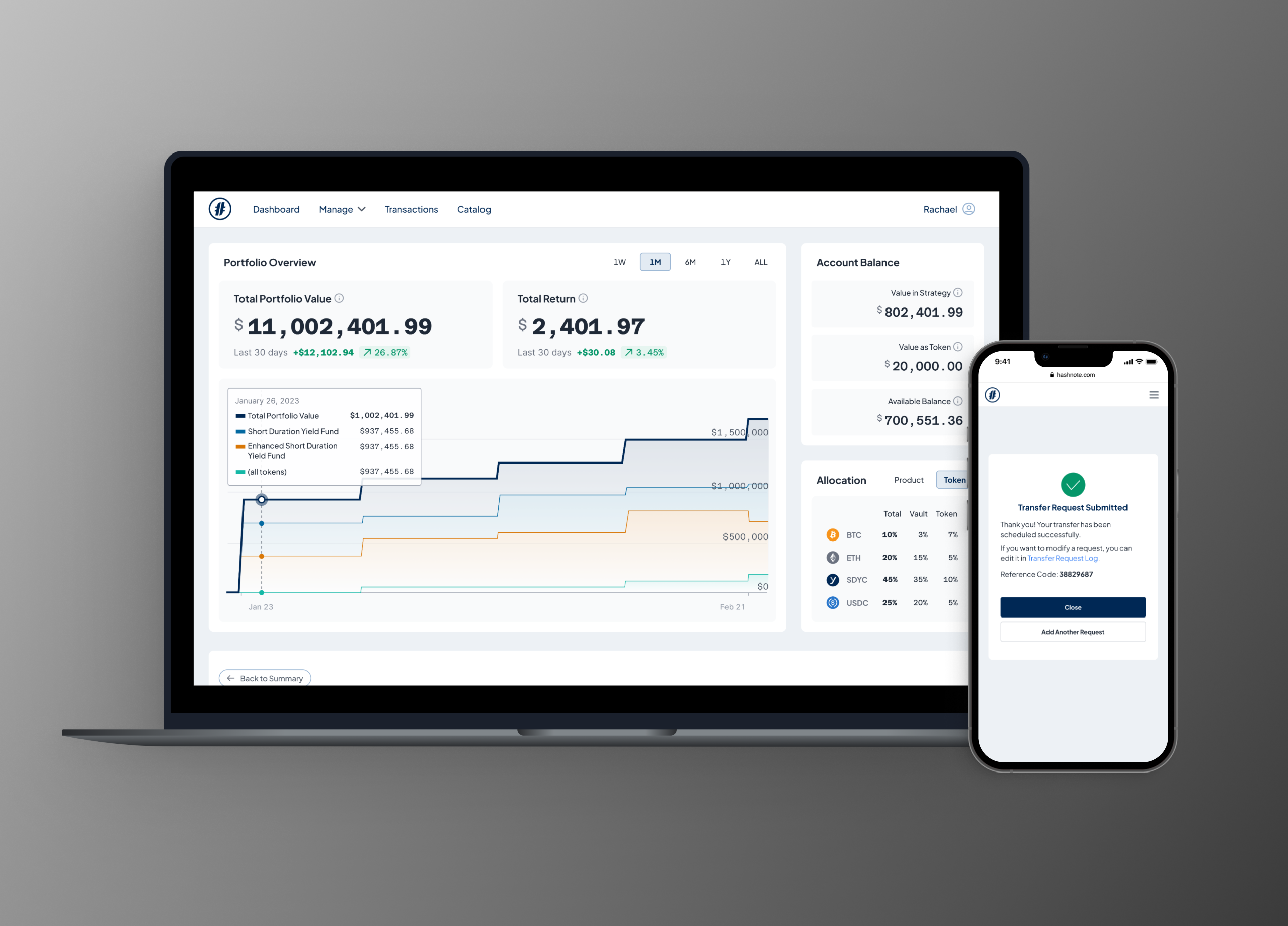

Hashnote is an institutional crypto asset manager offering options-based investment strategies and a proprietary crypto money-market fund (USYC). As the firm scaled beyond its MVP phase, core investor workflows—such as fund transfers, rebalancing, and redemptions—were managed through manual processes involving email, PDFs, and coordination with operations and legal teams.

The Problem: Operational Complexity at Scale

As Hashnote’s assets under management grew, core fund-management actions—such as transfers and allocations—were still handled through manual, offline processes. Each request triggered multiple rounds of coordination between investors, operations, legal, and sales teams, often stretching execution timelines into days or even weeks, particularly around fixed weekly processing windows. The design challenge became pressing and clear:

Institutional investors need a more efficient way to subscribe, redeem, and reallocate funds.

Design Approach

Key concepts explored and tested included: Portfolio rebalancing across multiple funds and allocations; Modular fund enter & exit for incremental capital movement among other options.

Early ideation surfaced critical feedback around usability and technical constraints, guiding the team toward more focused and scalable solutions shown blow:

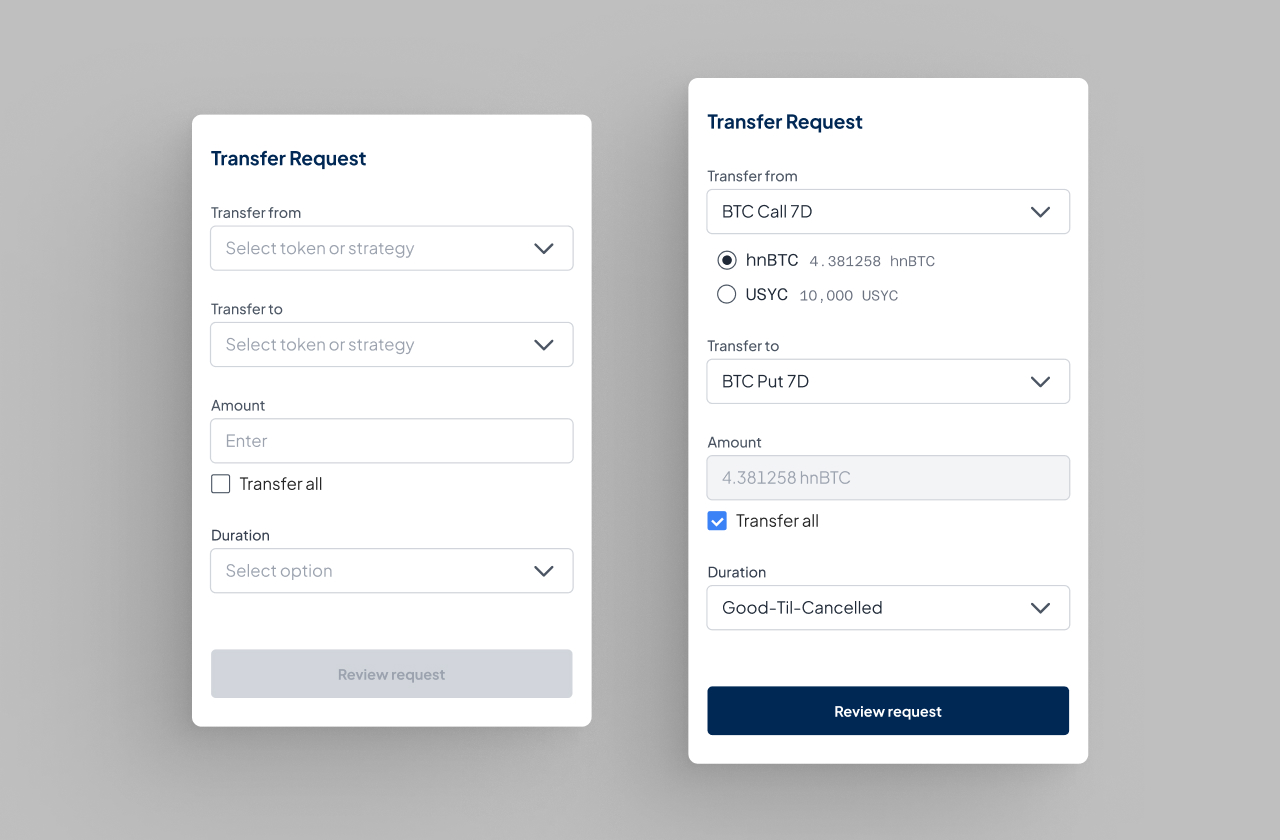

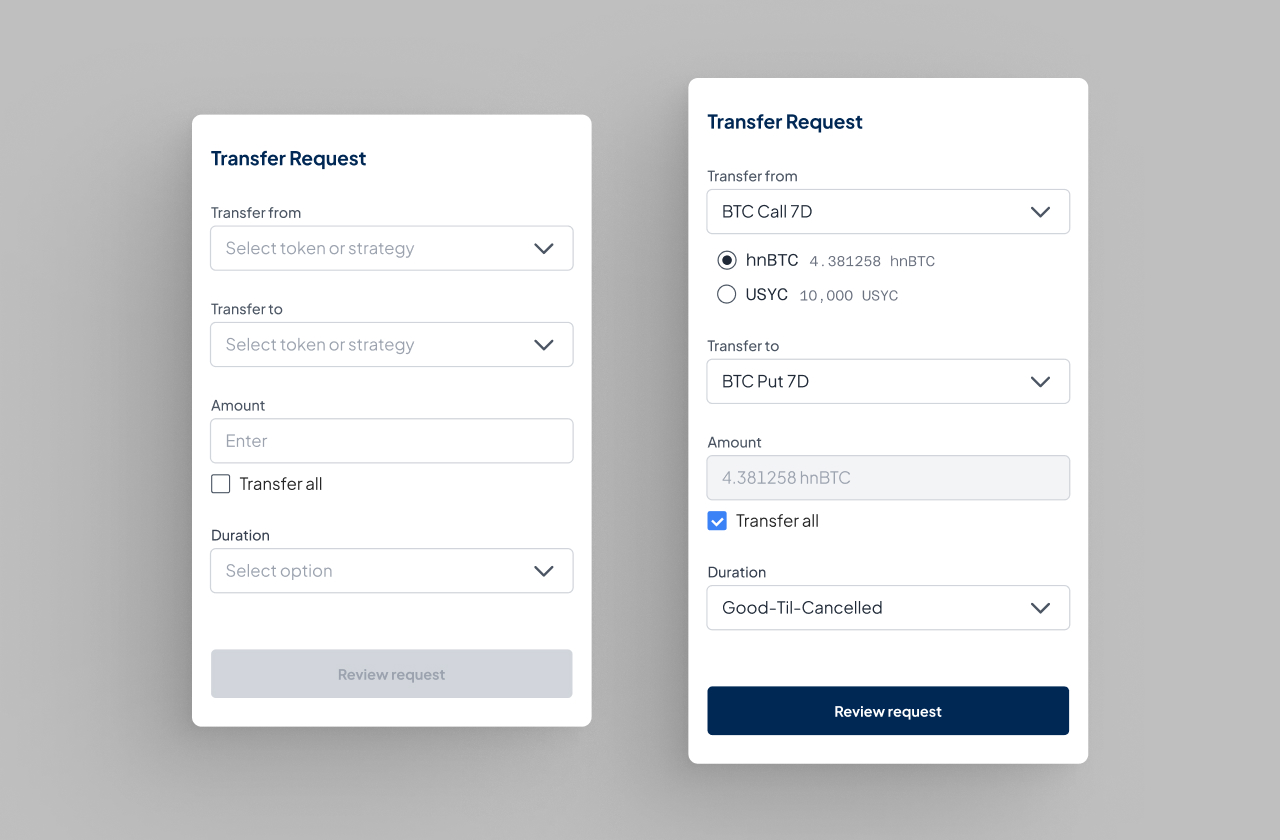

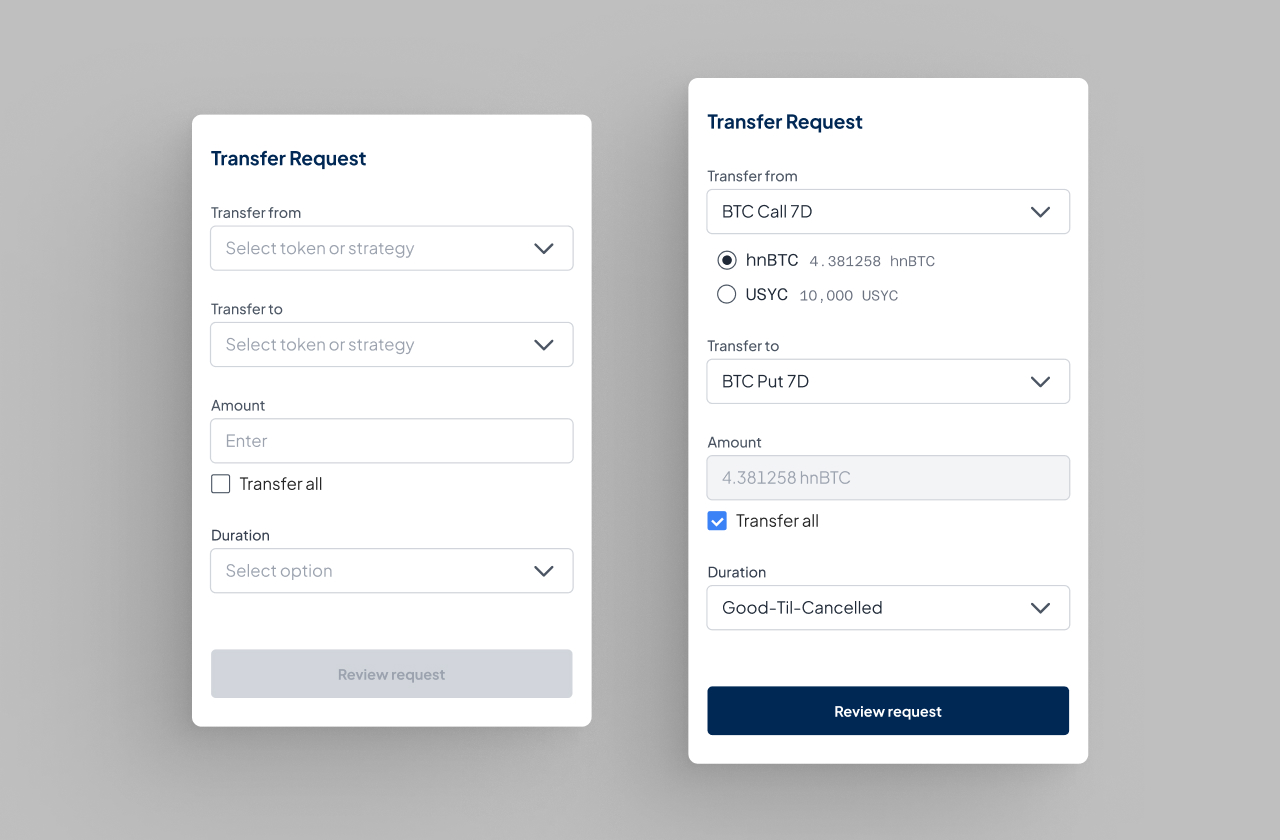

1. Unified Transfer Module

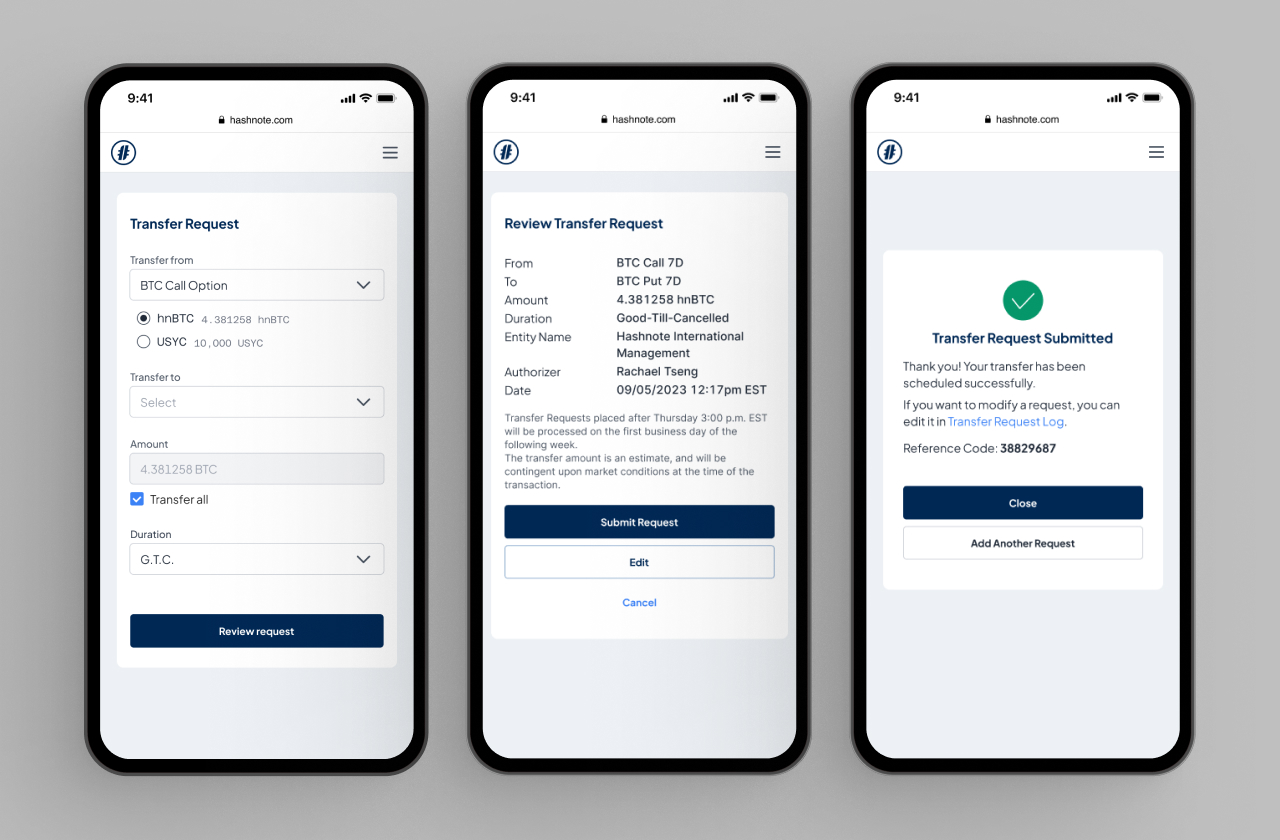

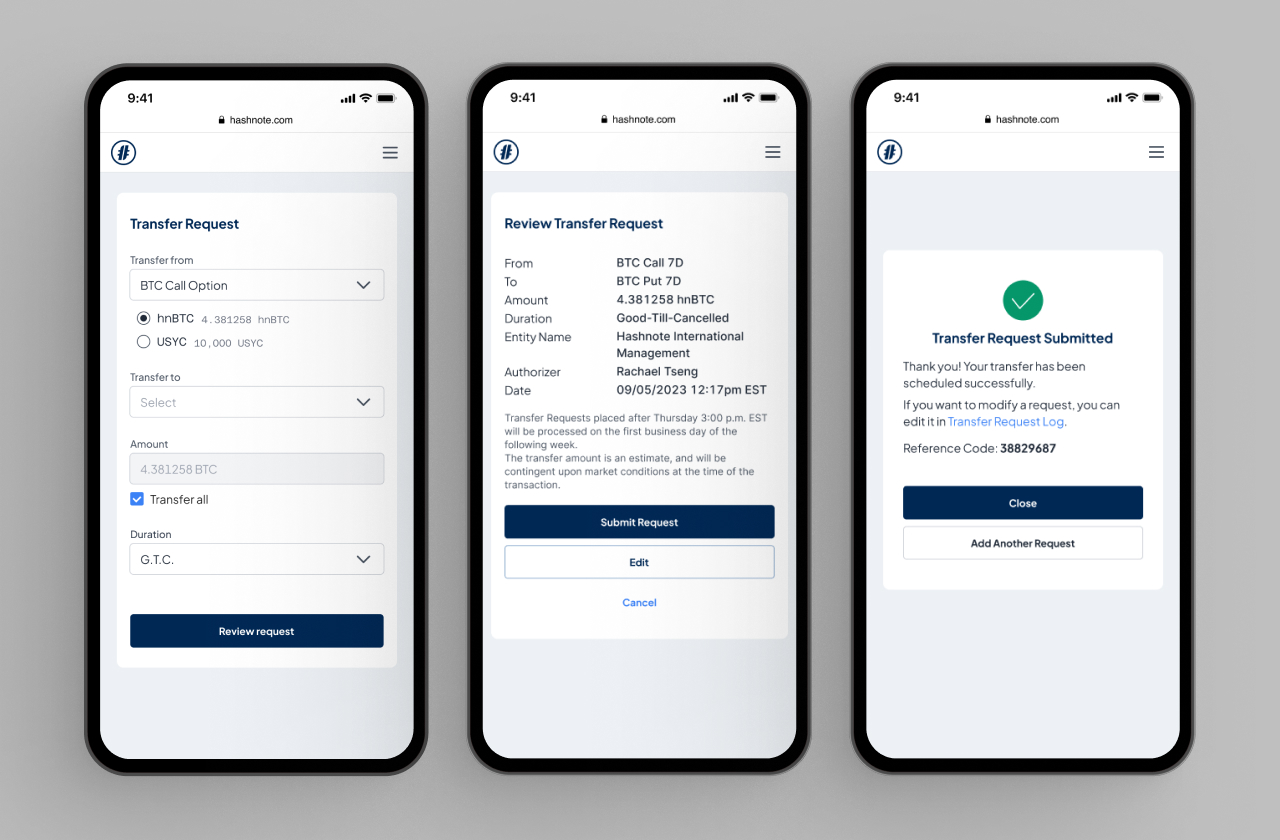

Inspired by the simplicity of swap interfaces—but adapted for institutional finance—the transfer module allowed users to Select source and destination funds; Specify auto-detected asset type (stablecoin, tokenized fund, strategy); Enter transfer amounts, execution timing that aligns with weekly operations; View contextual constraints, real-time validations responding to user inputs

2. Context-Aware Guardrails

To balance control with safety: Legal and technical disclosures appeared only when relevant; Users could cancel requests before cutoff times. This eliminated ambiguity without overwhelming the interface.

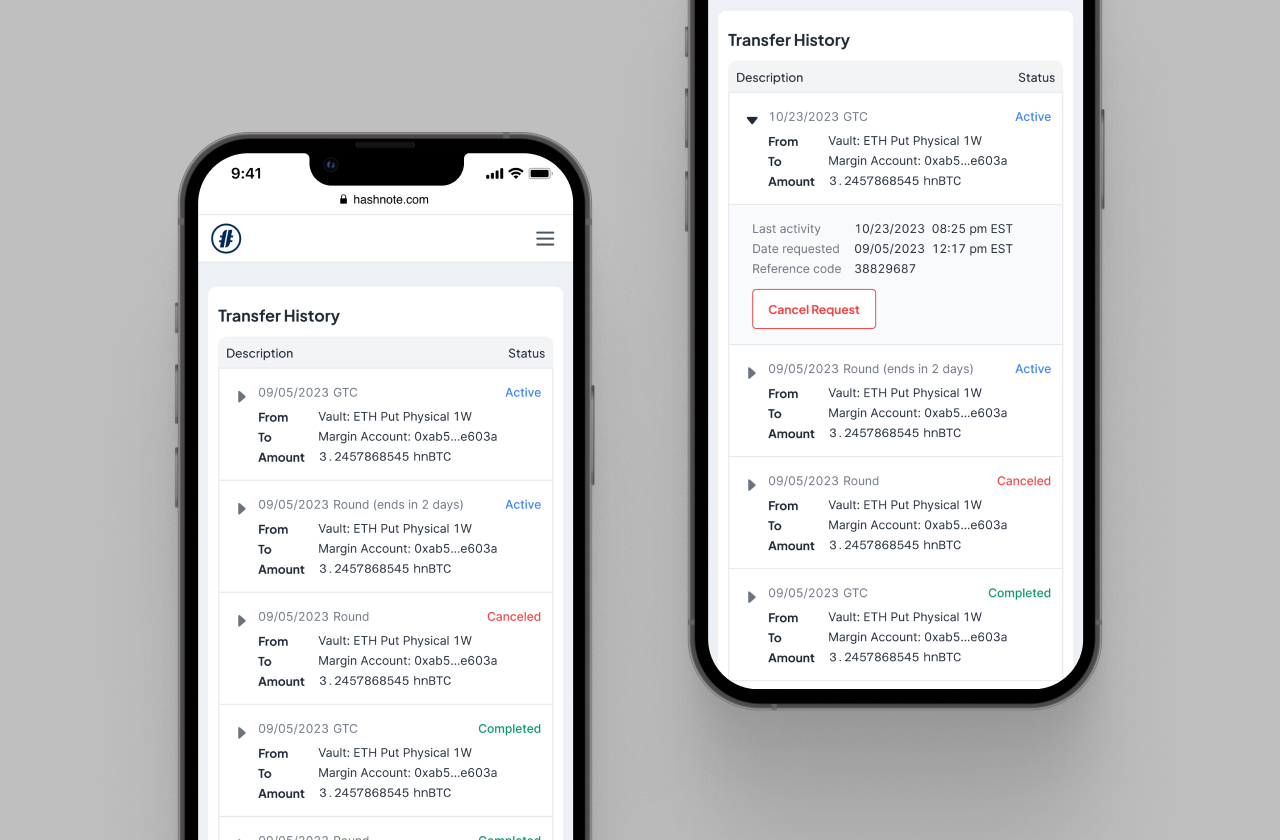

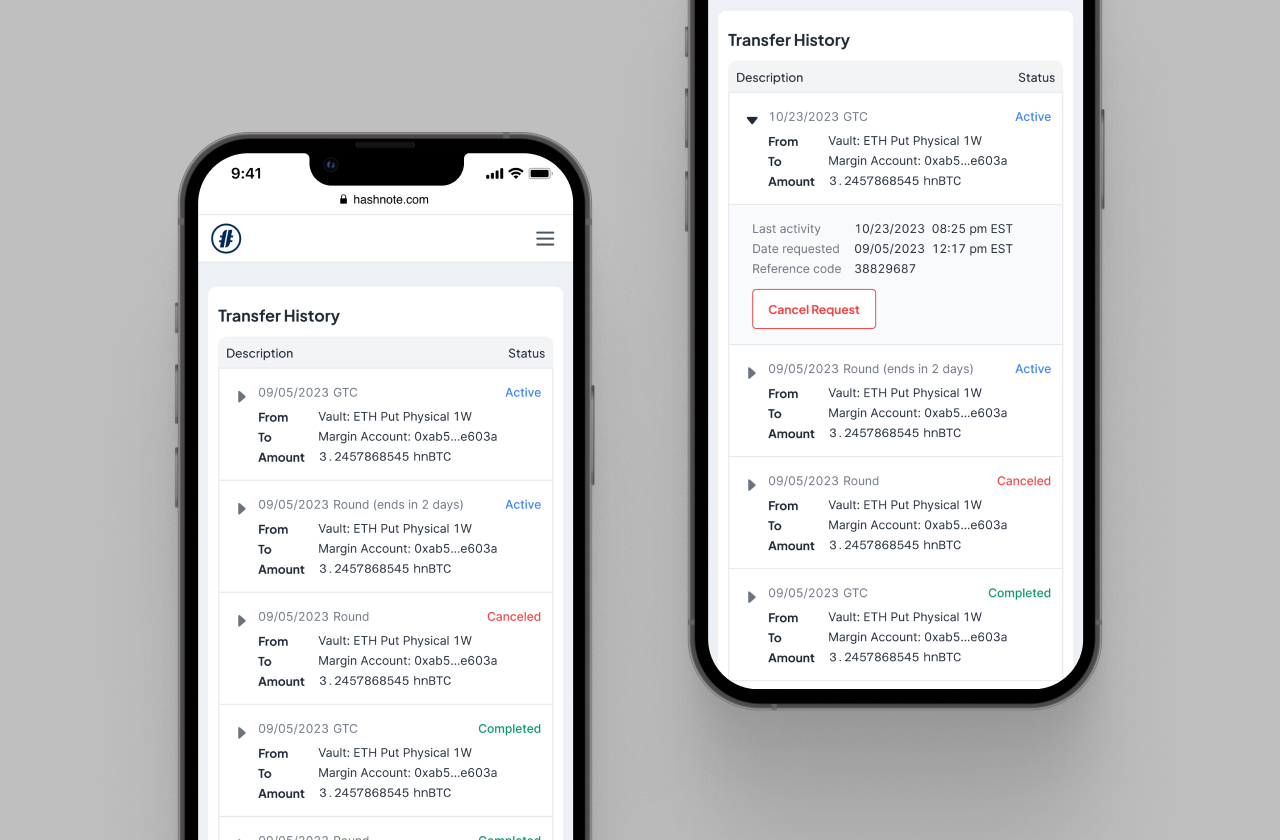

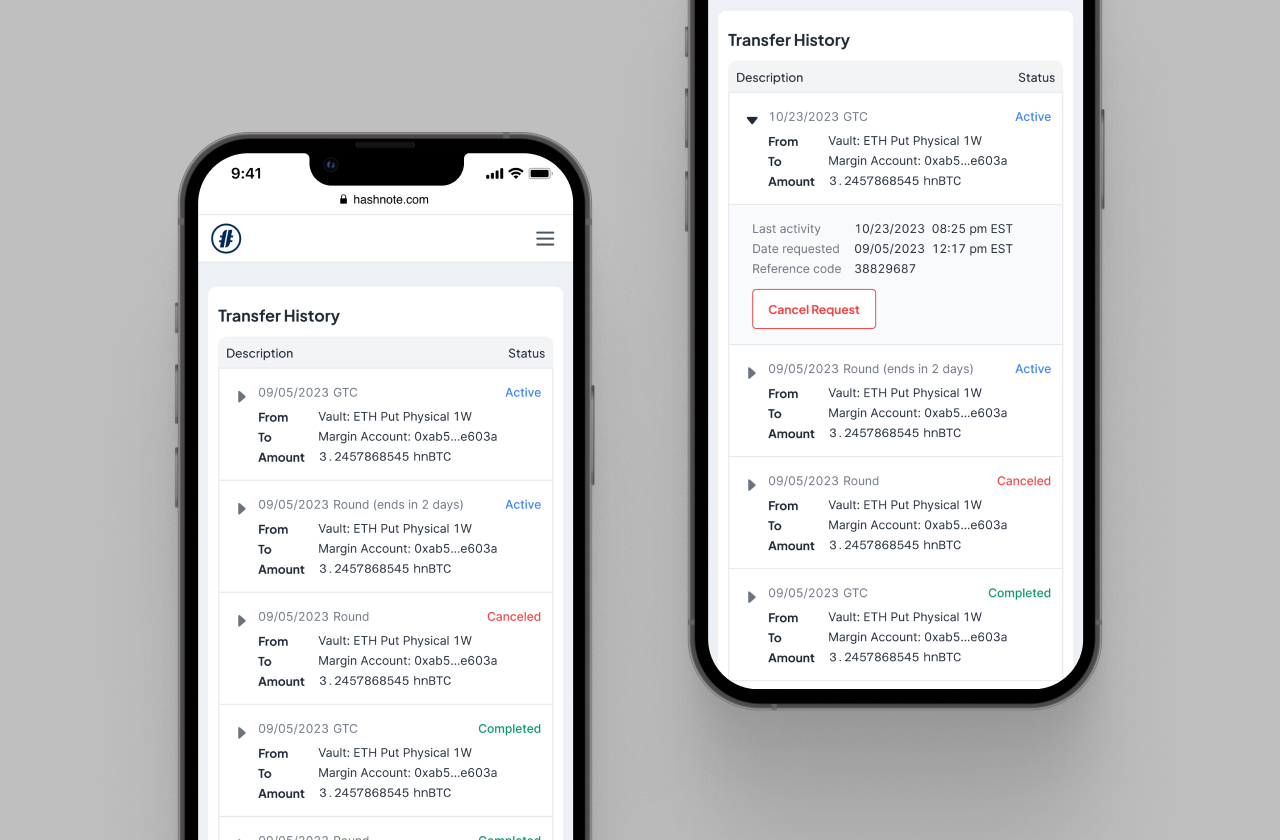

3. Status & Visibility

A dedicated Transfer History panel provided: Clear request states: Active → Completed → Canceled; Timestamps tied to operational cycles. Full visibility & Support when needed: this significantly reduced customer service dependency.

Multi-Chain Support

While AUM growth was driven by the underlying financial products, the investor portal: Enabled self-service fund management at scale and Supported platform growth to $1.5B AUM (as of Jan 2025) without proportional ops expansion.

This project reshaped how I approach product design in high-stakes domains: In institutional finance, UX extends beyond interfaces into service design, where operations, compliance, and trust are part of the experience. Design became a decision-making tool—using prototypes and system thinking to reduce ambiguity, align stakeholders, and translate complex financial logic into clear, actionable interactions.

Works →

From Complexity to Simplicity

Hashnote • 2023 - 2024 • Product Designer

Crypto

DeFi

Fintech

Project Type: Institutional Crypto Investor Portal

Role & Scope: Product Designer. Research, UX, UI, Design Systems

Team: Stakeholder, Customer Success, Engineering, Legal, Product Design

Outcome: Supported platform scaling to $1.5B AUM

Hashnote is an institutional crypto asset manager offering options-based investment strategies and a proprietary crypto money-market fund (USYC). As the firm scaled beyond its MVP phase, core investor workflows—such as fund transfers, rebalancing, and redemptions—were managed through manual processes involving email, PDFs, and coordination with operations and legal teams.

The Problem: Operational Complexity at Scale

As Hashnote’s assets under management grew, core fund-management actions—such as transfers and allocations—were still handled through manual, offline processes. Each request triggered multiple rounds of coordination between investors, operations, legal, and sales teams, often stretching execution timelines into days or even weeks, particularly around fixed weekly processing windows. The design challenge became pressing and clear:

Institutional investors need a more efficient way to subscribe, redeem, and reallocate funds.

Design Approach

Key concepts explored and tested included: Portfolio rebalancing across multiple funds and allocations; Modular fund enter & exit for incremental capital movement among other options.

Early ideation surfaced critical feedback around usability and technical constraints, guiding the team toward more focused and scalable solutions shown blow:

1. Unified Transfer Module

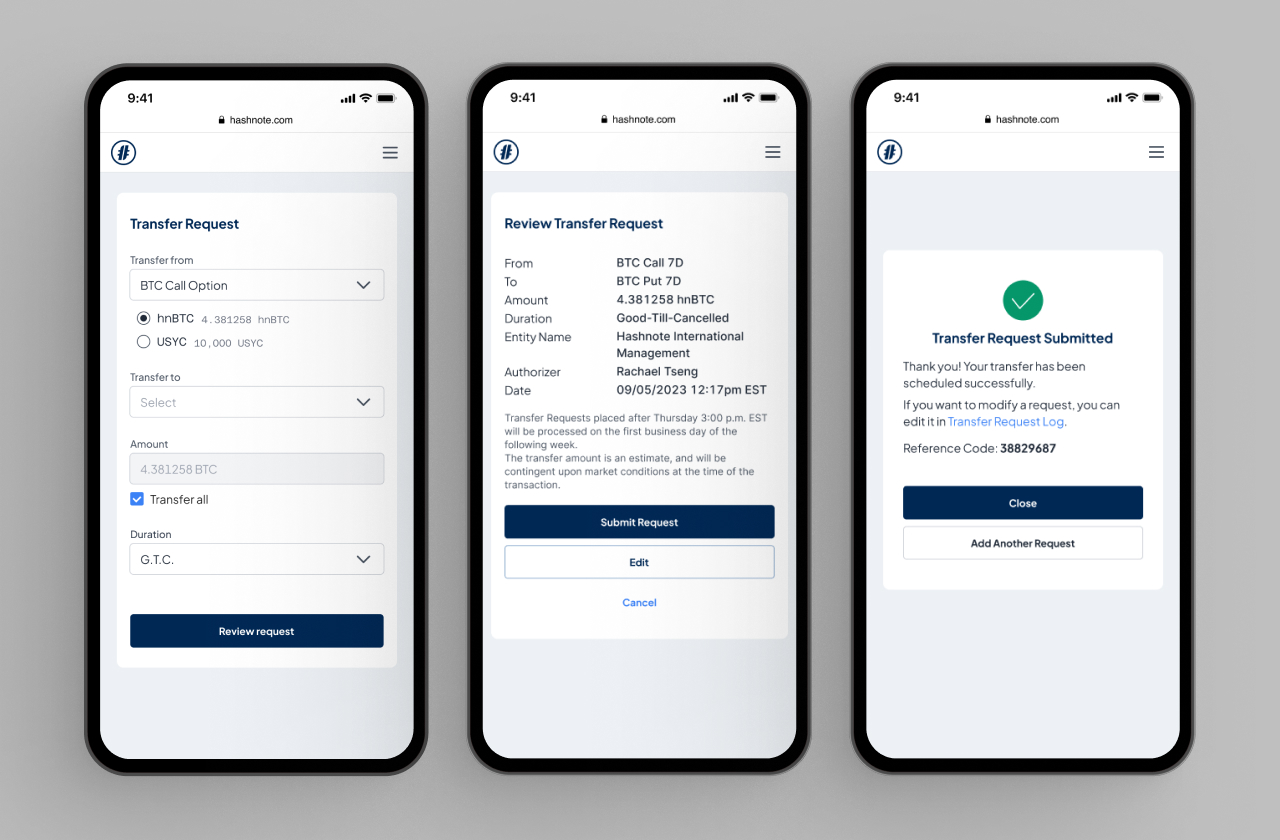

Inspired by the simplicity of swap interfaces—but adapted for institutional finance—the transfer module allowed users to Select source and destination funds; Specify auto-detected asset type (stablecoin, tokenized fund, strategy); Enter transfer amounts, execution timing that aligns with weekly operations; View contextual constraints, real-time validations responding to user inputs

2. Context-Aware Guardrails

To balance control with safety: Legal and technical disclosures appeared only when relevant; Users could cancel requests before cutoff times. This eliminated ambiguity without overwhelming the interface.

3. Status & Visibility

A dedicated Transfer History panel provided: Clear request states: Active → Completed → Canceled; Timestamps tied to operational cycles. Full visibility & Support when needed: this significantly reduced customer service dependency.

Multi-Chain Support

While AUM growth was driven by the underlying financial products, the investor portal: Enabled self-service fund management at scale and Supported platform growth to $1.5B AUM (as of Jan 2025) without proportional ops expansion.

This project reshaped how I approach product design in high-stakes domains: In institutional finance, UX extends beyond interfaces into service design, where operations, compliance, and trust are part of the experience. Design became a decision-making tool—using prototypes and system thinking to reduce ambiguity, align stakeholders, and translate complex financial logic into clear, actionable interactions.

Works →

From Complexity to Simplicity

Hashnote • 2023 - 2024 • Product Designer

Crypto

DeFi

Fintech

Project Type: Institutional Crypto Investor Portal

Role & Scope: Product Designer. Research, UX, UI, Design Systems

Team: Stakeholder, Customer Success, Engineering, Legal, Product Design

Outcome: Supported platform scaling to $1.5B AUM

Hashnote is an institutional crypto asset manager offering options-based investment strategies and a proprietary crypto money-market fund (USYC). As the firm scaled beyond its MVP phase, core investor workflows—such as fund transfers, rebalancing, and redemptions—were managed through manual processes involving email, PDFs, and coordination with operations and legal teams.

The Problem: Operational Complexity at Scale

As Hashnote’s assets under management grew, core fund-management actions—such as transfers and allocations—were still handled through manual, offline processes. Each request triggered multiple rounds of coordination between investors, operations, legal, and sales teams, often stretching execution timelines into days or even weeks, particularly around fixed weekly processing windows. The design challenge became pressing and clear:

Institutional investors require a streamlined process for subscribing, redeeming, and reallocating their funds.

Design Approach

Key concepts explored and tested included: Portfolio rebalancing across multiple funds and allocations; Modular fund enter & exit for incremental capital movement among other options.

Early ideation surfaced critical feedback around usability and technical constraints, guiding the team toward more focused and scalable solutions shown blow:

1. Unified Transfer Module

Inspired by the simplicity of swap interfaces—but adapted for institutional finance—the transfer module allowed users to Select source and destination funds; Specify auto-detected asset type (stablecoin, tokenized fund, strategy); Enter transfer amounts, execution timing that aligns with weekly operations; View contextual constraints, real-time validations responding to user inputs

2. Context-Aware Guardrails

To balance control with safety: Legal and technical disclosures appeared only when relevant; Users could cancel requests before cutoff times. This eliminated ambiguity without overwhelming the interface.

3. Status & Visibility

A dedicated Transfer History panel provided: Clear request states: Active → Completed → Canceled; Timestamps tied to operational cycles. Full visibility & Support when needed: this significantly reduced customer service dependency.

Takeaways

While AUM growth was driven by the underlying financial products, the investor portal: Enabled self-service fund management at scale and Supported platform growth to $1.5B AUM (as of Jan 2025) without proportional ops expansion.

This project reshaped how I approach product design in high-stakes domains: In institutional finance, UX extends beyond interfaces into service design, where operations, compliance, and trust are part of the experience. Design became a decision-making tool—using prototypes and system thinking to reduce ambiguity, align stakeholders, and translate complex financial logic into clear, actionable interactions.

Works →